Exploring the Benefits of Comprehensive Health Plans for Well-Being

The Importance of Health Plans in Ensuring Well-Being

Health plans play a crucial role in safeguarding individuals’ physical, mental, and financial well-being. These comprehensive strategies are designed to provide access to quality healthcare services while managing the costs associated with medical treatments.

One of the primary benefits of having a health plan is the ability to receive preventive care. Regular check-ups, screenings, and vaccinations can help detect potential health issues early on, allowing for timely intervention and treatment. By promoting preventive care, health plans aim to reduce the likelihood of more serious health complications down the line.

Moreover, health plans offer financial protection against unexpected medical expenses. In the event of an illness or injury, individuals covered by a health plan can benefit from reduced out-of-pocket costs for doctor visits, hospital stays, prescription medications, and other healthcare services. This financial security provides peace of mind and ensures that individuals can focus on their recovery without worrying about exorbitant medical bills.

Additionally, many health plans include coverage for mental health services, such as therapy and counseling. Mental well-being is an integral component of overall health, and access to mental health resources can help individuals cope with stress, anxiety, depression, and other emotional challenges.

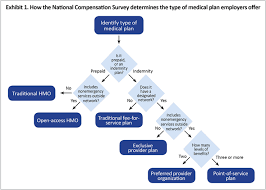

When selecting a health plan, it is essential to consider factors such as coverage options, network providers, premiums, deductibles, and co-payments. By choosing a plan that aligns with one’s healthcare needs and budgetary constraints, individuals can ensure comprehensive coverage that meets their unique requirements.

In conclusion, health plans are instrumental in promoting overall well-being by providing access to preventive care, financial protection against medical expenses, and support for mental health services. By enrolling in a suitable health plan tailored to individual needs, individuals can proactively manage their health and secure a healthier future.

8 Benefits of Health Plans: Comprehensive Coverage and Financial Protection

- Access to preventive care services for early detection of health issues.

- Financial protection against high medical expenses and unexpected healthcare costs.

- Coverage for a wide range of medical treatments, including hospital stays and prescription medications.

- Support for mental health services such as therapy and counseling.

- In-network providers offering discounted rates for covered services.

- Wellness programs and resources to promote healthy lifestyle choices.

- Coordination of care among healthcare providers to ensure comprehensive treatment.

- Flexibility to choose from different plan options based on individual healthcare needs and budget.

Challenges of Health Plans: Restricted Networks, High Costs, and Complex Coverage

- Limited provider networks may restrict access to preferred healthcare providers.

- High deductibles and co-payments can result in significant out-of-pocket expenses for medical services.

- Complexity of plan options and coverage details may lead to confusion and difficulty in understanding benefits.

Access to preventive care services for early detection of health issues.

Health plans offer a significant advantage in providing access to preventive care services for the early detection of health issues. By covering routine check-ups, screenings, and vaccinations, health plans enable individuals to proactively monitor their health and identify potential concerns at an early stage. This proactive approach not only helps in preventing the development of serious health conditions but also allows for timely intervention and treatment, ultimately leading to better health outcomes and improved quality of life.

Financial protection against high medical expenses and unexpected healthcare costs.

Health plans offer a valuable pro in providing financial protection against high medical expenses and unexpected healthcare costs. By enrolling in a health plan, individuals can mitigate the financial burden associated with medical treatments, hospital stays, prescription medications, and other healthcare services. This coverage ensures that individuals have access to necessary care without facing overwhelming out-of-pocket expenses, allowing them to focus on their health and well-being rather than worrying about the cost of treatment.

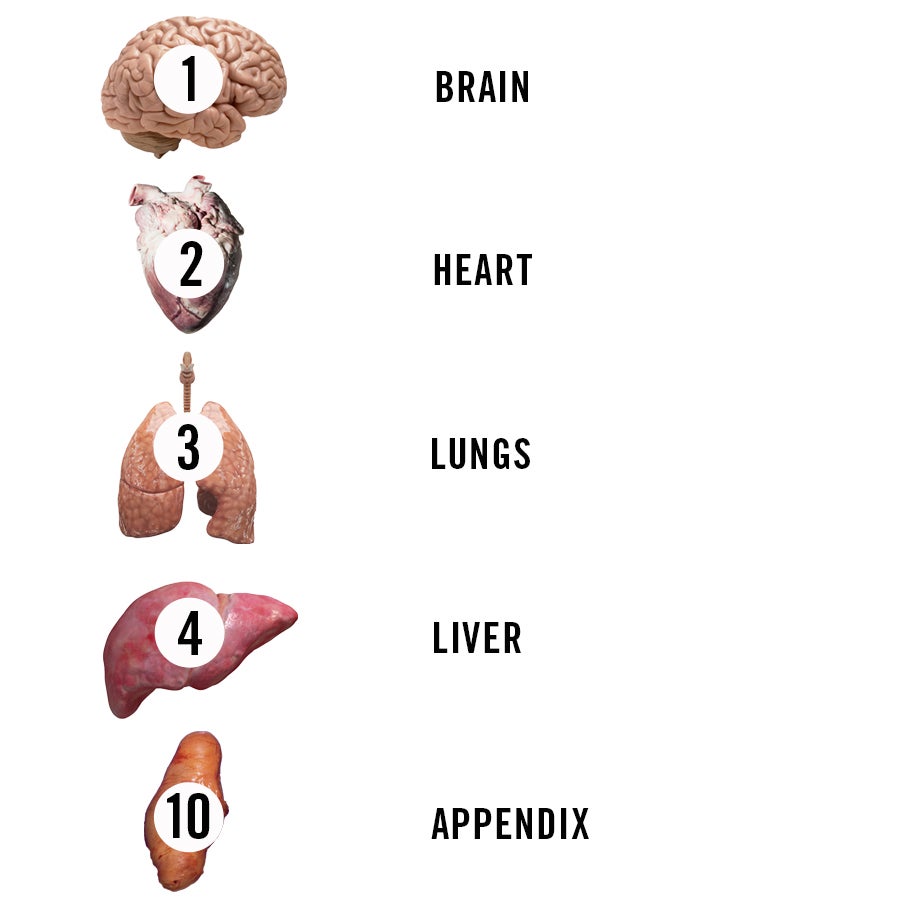

Coverage for a wide range of medical treatments, including hospital stays and prescription medications.

One significant advantage of health plans is their comprehensive coverage for a diverse array of medical treatments, encompassing hospital stays and prescription medications. This aspect ensures that individuals have access to the necessary care and medications they need to address various health conditions effectively. By providing coverage for hospitalization and prescription drugs, health plans offer financial assistance in managing the costs associated with serious illnesses or injuries, enabling individuals to receive timely and appropriate medical treatment without bearing the full financial burden.

Support for mental health services such as therapy and counseling.

One significant advantage of health plans is the provision of support for mental health services, including therapy and counseling. This aspect of health plans underscores the recognition of mental well-being as a crucial component of overall health. By offering coverage for mental health services, individuals can access the necessary resources to address and manage conditions such as stress, anxiety, depression, and other mental health challenges. This support not only promotes emotional resilience and well-being but also contributes to a holistic approach to healthcare that prioritizes both physical and mental wellness.

In-network providers offering discounted rates for covered services.

One significant advantage of health plans is the access to in-network providers who offer discounted rates for covered services. By utilizing healthcare professionals within the plan’s network, individuals can benefit from reduced costs for medical treatments, consultations, and procedures. This feature not only makes healthcare more affordable but also encourages individuals to seek care from qualified providers who have established relationships with the insurance company. Choosing in-network providers can lead to significant cost savings and ensure that individuals receive high-quality healthcare services at a more affordable price point.

Wellness programs and resources to promote healthy lifestyle choices.

Health plans offer a valuable pro by providing wellness programs and resources that promote healthy lifestyle choices. These initiatives empower individuals to take proactive steps towards improving their health and well-being through activities such as fitness programs, nutritional counseling, stress management techniques, and smoking cessation support. By encouraging healthy habits and behaviors, health plans not only help prevent chronic diseases but also enhance overall quality of life for their members.

Coordination of care among healthcare providers to ensure comprehensive treatment.

One significant advantage of health plans is the coordination of care among healthcare providers to ensure comprehensive treatment for individuals. By facilitating communication and collaboration between different specialists, primary care physicians, hospitals, and other healthcare facilities, health plans help streamline the patient’s journey through the healthcare system. This coordinated approach ensures that all aspects of a patient’s health are taken into consideration, leading to more effective and holistic treatment plans that address their unique needs and promote better health outcomes.

Flexibility to choose from different plan options based on individual healthcare needs and budget.

One significant advantage of health plans is the flexibility they offer in selecting from a variety of plan options tailored to individual healthcare needs and budget constraints. This flexibility allows individuals to choose a plan that aligns with their specific health requirements, whether they prioritize access to a wide network of providers, lower premiums, higher coverage limits, or specific benefits such as prescription drug coverage or mental health services. By having the freedom to select from different plan options, individuals can customize their healthcare coverage to best suit their unique circumstances and preferences, ensuring that they receive the care they need within a budget that works for them.

Limited provider networks may restrict access to preferred healthcare providers.

One significant drawback of health plans is the limitation imposed by provider networks, which can restrict individuals’ access to their preferred healthcare providers. In some cases, individuals may find that the doctors or specialists they have established relationships with are not included in the approved network of their health plan. This limitation can be frustrating and may result in individuals having to switch to unfamiliar healthcare providers, potentially disrupting continuity of care and affecting the quality of the patient-provider relationship. The restricted access to preferred healthcare providers highlights a key con of health plans, as individuals may feel constrained in their choices and may not receive care from providers they trust and are comfortable with.

High deductibles and co-payments can result in significant out-of-pocket expenses for medical services.

One notable downside of health plans is the potential for high deductibles and co-payments, which can lead to substantial out-of-pocket expenses for medical services. Individuals may find themselves facing financial strain when required to pay significant amounts before their insurance coverage kicks in or when sharing the cost of services through co-payments. These expenses can create barriers to accessing necessary healthcare and may deter individuals from seeking timely medical treatment, ultimately impacting their health outcomes.

Complexity of plan options and coverage details may lead to confusion and difficulty in understanding benefits.

The complexity of health plan options and coverage details can present a significant challenge, leading to confusion and difficulty in understanding the benefits offered. With a multitude of plan choices, varying levels of coverage, and intricate policy details, individuals may find it overwhelming to navigate through the fine print and grasp the extent of their healthcare benefits. This lack of clarity can result in misunderstandings, potential gaps in coverage, and suboptimal utilization of available services, ultimately hindering individuals from maximizing the full potential of their health plans.