Essential Guide to Medical Travel Insurance: Ensuring Peace of Mind Abroad

Understanding the Importance of Medical Travel Insurance

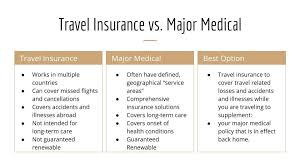

Medical travel insurance is a crucial aspect to consider when planning a trip abroad for medical treatment. It provides coverage for unexpected medical expenses, emergencies, and other unforeseen circumstances that may arise during your travels.

One of the key benefits of medical travel insurance is that it offers financial protection against high healthcare costs in a foreign country. Without adequate insurance coverage, receiving medical treatment overseas can be extremely costly and may lead to financial strain.

In addition to covering medical expenses, some travel insurance policies also include benefits such as emergency evacuation, repatriation of remains, and coverage for travel-related issues like trip cancellations or delays. These additional benefits can provide peace of mind and security while you are away from home.

When choosing a medical travel insurance policy, it is important to carefully review the coverage details, limitations, and exclusions. Be sure to disclose any pre-existing medical conditions to ensure that you are properly covered in case of related emergencies.

Ultimately, investing in medical travel insurance is a wise decision that can protect you from unforeseen circumstances and give you the confidence to focus on your health and recovery during your time abroad. It is an essential part of any comprehensive travel plan for individuals seeking medical treatment overseas.

Everything You Need to Know About Medical Travel Insurance: FAQs Answered

- What is medical travel insurance?

- Why do I need medical travel insurance?

- What does medical travel insurance cover?

- Are pre-existing conditions covered by medical travel insurance?

- How much does medical travel insurance cost?

- How do I choose the right medical travel insurance policy?

- What should I do if I need to use my medical travel insurance while abroad?

What is medical travel insurance?

Medical travel insurance is a specialized type of insurance that provides coverage for individuals traveling abroad for medical treatment. This insurance is designed to protect patients from unexpected medical expenses, emergencies, and other unforeseen circumstances that may arise during their time overseas. Medical travel insurance typically includes benefits such as coverage for medical treatments, emergency evacuation, repatriation of remains, and assistance with travel-related issues. It offers financial protection and peace of mind to individuals seeking healthcare services in foreign countries, ensuring that they can focus on their health and well-being without worrying about the financial implications of medical emergencies while away from home.

Why do I need medical travel insurance?

Medical travel insurance is essential for anyone considering traveling abroad for medical treatment. It provides crucial coverage for unexpected medical expenses, emergencies, and unforeseen circumstances that may arise during your medical journey. Without adequate insurance, the cost of healthcare in a foreign country can be exorbitant and potentially overwhelming. Medical travel insurance offers financial protection, peace of mind, and security, ensuring that you can focus on your health and recovery without worrying about the financial implications of medical care while away from home.

What does medical travel insurance cover?

Medical travel insurance typically covers a range of services and expenses related to healthcare while traveling abroad. This may include coverage for emergency medical treatment, hospitalization, surgery, prescription medications, and doctor consultations. Additionally, medical travel insurance often provides benefits for emergency medical evacuation, repatriation of remains, and coverage for pre-existing conditions in certain cases. It is important to carefully review the specific policy details to understand the extent of coverage and any exclusions that may apply. Having medical travel insurance can offer peace of mind knowing that you are financially protected in case of unexpected health issues during your trip.

Are pre-existing conditions covered by medical travel insurance?

Pre-existing conditions are a common concern when it comes to medical travel insurance. Coverage for pre-existing conditions can vary depending on the insurance provider and policy terms. It is important to carefully review the details of the insurance policy to understand if pre-existing conditions are covered, to what extent, and any limitations or exclusions that may apply. Some insurance plans may offer coverage for pre-existing conditions with certain conditions or restrictions, while others may exclude them altogether. Disclosing any pre-existing conditions accurately and transparently when purchasing medical travel insurance is crucial to ensure that you have the appropriate coverage in case of related emergencies during your travels.

How much does medical travel insurance cost?

The cost of medical travel insurance can vary depending on various factors such as the duration of your trip, destination, age, coverage limits, and any pre-existing medical conditions. Generally, medical travel insurance costs are calculated based on these variables and the level of coverage you choose. It is important to compare different insurance plans to find one that fits your needs and budget while providing adequate protection for unexpected medical expenses during your travels. Remember that investing in medical travel insurance is a valuable safeguard against potentially high healthcare costs abroad and offers peace of mind throughout your journey.

How do I choose the right medical travel insurance policy?

When considering how to choose the right medical travel insurance policy, it is essential to evaluate your specific needs and circumstances. Start by assessing the coverage options offered by different insurance providers, considering factors such as coverage limits, deductibles, exclusions, and additional benefits like emergency evacuation or repatriation. It is crucial to review the policy details carefully and ensure that it aligns with your medical history and any pre-existing conditions you may have. Comparing quotes from multiple insurers can help you find a policy that offers comprehensive coverage at a competitive price. Additionally, seek recommendations from healthcare providers or travel experts to guide you in selecting a reputable insurance provider known for reliable service and efficient claims processing. By conducting thorough research and understanding your individual requirements, you can make an informed decision when choosing the right medical travel insurance policy for your upcoming journey.

What should I do if I need to use my medical travel insurance while abroad?

In the event that you need to utilize your medical travel insurance while abroad, it is essential to act promptly and follow the necessary steps for a smooth claims process. Firstly, contact your insurance provider or their designated assistance service as soon as possible to inform them of your situation and seek guidance on the next steps. Be prepared to provide details of your policy, medical condition, location, and any relevant documentation such as medical reports or receipts. Follow any instructions given by the insurance provider regarding treatment options, healthcare facilities, and claim procedures. Keep all receipts and documentation related to your medical expenses for reimbursement purposes. By staying proactive and communicating effectively with your insurance provider, you can ensure that you receive the necessary support and assistance during a medical emergency while abroad.