Navigating the Benefits of the Affordable Care Act: A Guide for Americans

The Affordable Care Act: A Comprehensive Overview

The Affordable Care Act (ACA), also known as Obamacare, is a landmark healthcare reform legislation enacted in the United States in 2010. The ACA aimed to increase the quality and affordability of health insurance, expand healthcare coverage, and reduce the overall costs of healthcare for individuals and the government.

One of the key provisions of the ACA is the establishment of health insurance marketplaces where individuals and small businesses can compare and purchase health insurance plans. These marketplaces offer a range of options to suit different needs and budgets, making it easier for individuals to find affordable coverage.

Another important aspect of the ACA is the expansion of Medicaid eligibility to cover more low-income individuals and families. This expansion has helped millions of Americans gain access to essential healthcare services that were previously out of reach.

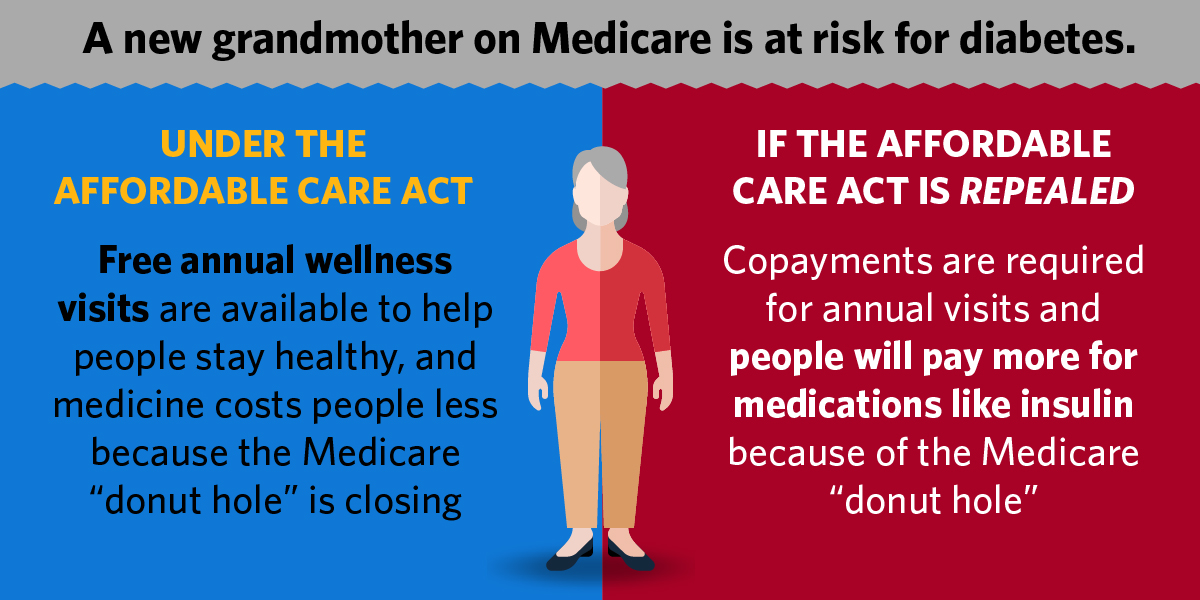

Under the ACA, insurance companies are also prohibited from denying coverage or charging higher premiums based on pre-existing conditions. This provision has provided peace of mind to many Americans who were previously unable to obtain adequate health insurance due to their medical history.

Furthermore, the ACA includes provisions that aim to improve the quality of care provided by healthcare providers and hospitals. It incentivizes preventive care, wellness programs, and better coordination of care to ensure that patients receive high-quality treatment at lower costs.

While the ACA has faced challenges and criticisms since its inception, it has undeniably had a significant impact on improving access to healthcare for millions of Americans. As debates continue about its future and potential reforms, one thing remains clear – the Affordable Care Act has reshaped the landscape of American healthcare in profound ways.

7 Essential Tips for Navigating the Affordable Care Act and Maximizing Your Benefits

- 1. Understand the basics of the Affordable Care Act (ACA) to make informed decisions.

- 2. Explore available health insurance options through the Health Insurance Marketplace.

- 3. Check if you qualify for subsidies or tax credits to lower your health insurance costs.

- 4. Take advantage of preventive services covered by ACA plans at no extra cost.

- 5. Stay informed about enrollment periods and deadlines to avoid penalties.

- 6. Consider Medicaid expansion in your state if you have limited income and resources.

- 7. Seek assistance from healthcare navigators or counselors for guidance on ACA coverage.

1. Understand the basics of the Affordable Care Act (ACA) to make informed decisions.

To make informed decisions regarding healthcare coverage, it is crucial to understand the basics of the Affordable Care Act (ACA). By familiarizing oneself with the key provisions of the ACA, individuals can better navigate the complexities of health insurance options and benefits. Understanding how the ACA impacts access to care, coverage for pre-existing conditions, and available subsidies can empower individuals to make choices that align with their healthcare needs and financial circumstances. Being informed about the ACA ensures that individuals can maximize the benefits of this landmark healthcare reform legislation and make well-informed decisions about their health insurance coverage.

2. Explore available health insurance options through the Health Insurance Marketplace.

To make the most of the Affordable Care Act, individuals are encouraged to explore available health insurance options through the Health Insurance Marketplace. This platform offers a convenient way to compare and select insurance plans that suit specific needs and budgets. By utilizing the Health Insurance Marketplace, individuals can access a range of affordable coverage options and potentially qualify for financial assistance to make healthcare more accessible and affordable. It is a valuable resource for those seeking quality health insurance plans tailored to their unique circumstances.

3. Check if you qualify for subsidies or tax credits to lower your health insurance costs.

Checking if you qualify for subsidies or tax credits can significantly lower your health insurance costs under the Affordable Care Act. These financial assistance programs are designed to make healthcare more affordable for individuals and families with lower incomes. By exploring your eligibility for subsidies or tax credits, you can access valuable financial support that can help offset the expenses of health insurance premiums, making quality healthcare coverage more accessible and budget-friendly.

4. Take advantage of preventive services covered by ACA plans at no extra cost.

Individuals enrolled in ACA plans can benefit from preventive services at no additional cost. This provision allows policyholders to access a range of preventive care services, such as screenings, vaccinations, and wellness visits, without incurring extra expenses. By taking advantage of these covered services, individuals can prioritize their health and well-being through early detection and prevention of potential health issues. This proactive approach not only promotes individual wellness but also contributes to overall cost savings by addressing health concerns before they escalate.

5. Stay informed about enrollment periods and deadlines to avoid penalties.

Staying informed about enrollment periods and deadlines is crucial when navigating the Affordable Care Act to avoid penalties. By staying up-to-date on when you can enroll in or change your health insurance plan, you can ensure that you maintain continuous coverage and comply with the law’s requirements. Missing deadlines could result in penalties or gaps in coverage, which may lead to financial consequences and limited access to healthcare services. Therefore, being proactive and aware of enrollment timelines is essential for maximizing the benefits of the Affordable Care Act while avoiding any potential pitfalls.

6. Consider Medicaid expansion in your state if you have limited income and resources.

Consider exploring the option of Medicaid expansion in your state if you have limited income and resources. Under the Affordable Care Act, Medicaid expansion provides an opportunity for individuals and families with low incomes to access essential healthcare services that may otherwise be unaffordable. By taking advantage of this provision, you can potentially qualify for comprehensive health coverage that can help alleviate the financial burden of medical expenses and ensure that you receive the care you need to stay healthy. Explore Medicaid expansion in your state to see if you meet the eligibility criteria and take a step towards securing affordable healthcare for yourself and your loved ones.

7. Seek assistance from healthcare navigators or counselors for guidance on ACA coverage.

Seeking assistance from healthcare navigators or counselors can be a valuable resource when navigating Affordable Care Act (ACA) coverage options. These professionals are trained to provide guidance and support in understanding the complexities of the ACA, helping individuals and families make informed decisions about their healthcare coverage. Whether you have questions about eligibility, plan options, or enrollment processes, healthcare navigators or counselors can offer personalized assistance to ensure you find the best ACA coverage that suits your needs and budget.