Understanding the Value of Comprehensive Coverage in Today’s World

The Importance of Comprehensive Coverage in Today’s World

Comprehensive coverage is a term that often comes up when discussing insurance, healthcare, or any form of protection. It refers to a type of coverage that includes a wide range of benefits, protections, and services to ensure complete security and peace of mind for individuals or entities.

In the realm of insurance, having comprehensive coverage means being safeguarded against various risks and potential losses. This type of policy typically covers not only basic liabilities but also additional risks such as theft, vandalism, natural disasters, and more. With comprehensive coverage, policyholders can rest assured that they are adequately protected in diverse situations.

Similarly, in healthcare, comprehensive coverage plays a vital role in ensuring access to a broad spectrum of medical services and treatments. A comprehensive health insurance plan can cover everything from routine check-ups and preventive care to emergency services, hospital stays, prescription medications, and specialist consultations. This expansive coverage is designed to address the diverse healthcare needs of individuals and families.

Beyond insurance and healthcare, the concept of comprehensive coverage extends to other areas such as cybersecurity, legal protection, travel assistance, and more. In each case, the goal is the same: to provide thorough protection and support across various aspects of life.

Having comprehensive coverage offers peace of mind by minimizing uncertainties and potential risks. It empowers individuals to navigate life’s challenges with confidence knowing that they have a safety net in place. Whether it’s protecting assets, maintaining good health, or securing personal data, comprehensive coverage serves as a valuable shield against unforeseen events.

In today’s fast-paced and unpredictable world, the importance of comprehensive coverage cannot be overstated. By investing in robust protection that covers a wide range of scenarios and contingencies, individuals can proactively safeguard their well-being and assets for a more secure future.

Understanding Comprehensive Coverage: FAQs on Deductibles, Definitions, and Policy Options

- Is it better to have a $500 deductible or $1000?

- What is the meaning of comprehensive coverage?

- Is it better to have collision or comprehensive?

- What does a comprehensive policy cover?

Is it better to have a $500 deductible or $1000?

When considering whether to choose a $500 deductible or a $1000 deductible for comprehensive coverage, the decision ultimately depends on individual circumstances and preferences. Opting for a lower deductible, such as $500, means you will pay less out of pocket before your insurance coverage kicks in. This can be advantageous if you anticipate needing to make claims frequently or if you prefer smaller upfront costs. On the other hand, selecting a higher deductible of $1000 may result in lower monthly premiums, offering savings in the long run if you rarely make claims. It’s essential to weigh your financial situation, risk tolerance, and potential healthcare needs to determine which deductible amount aligns best with your overall insurance strategy.

What is the meaning of comprehensive coverage?

Comprehensive coverage is a term commonly used in the insurance industry to describe a type of policy that provides extensive protection against a wide range of risks and potential losses. Unlike basic liability coverage, comprehensive coverage offers a more inclusive safeguard by encompassing various scenarios such as theft, vandalism, natural disasters, and other non-collision incidents. In essence, comprehensive coverage serves as a comprehensive safety net for policyholders, ensuring that they are adequately protected in diverse situations and providing peace of mind in the face of unforeseen events.

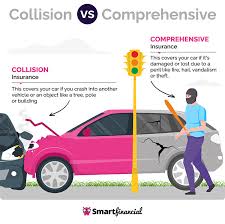

Is it better to have collision or comprehensive?

When considering whether it is better to have collision or comprehensive coverage, it is essential to understand the distinct purposes of each type of insurance. Collision coverage typically protects against damage to your vehicle resulting from a collision with another vehicle or object. On the other hand, comprehensive coverage provides protection for a broader range of incidents, such as theft, vandalism, natural disasters, and more. The decision between collision and comprehensive coverage depends on individual needs and risk factors. If you are concerned primarily about damage from collisions, collision coverage may be sufficient. However, if you seek more extensive protection against various unforeseen events, comprehensive coverage might be the better choice to ensure comprehensive financial security for your vehicle.

What does a comprehensive policy cover?

A comprehensive policy provides extensive coverage across a wide range of risks and scenarios, offering a comprehensive safety net for individuals or entities. Typically, a comprehensive policy covers not only basic liabilities but also additional protections such as theft, vandalism, natural disasters, and more. In the realm of insurance, this type of policy ensures that policyholders are safeguarded against various potential losses and uncertainties by providing robust coverage that goes beyond the essentials. Whether it’s protecting against property damage, unforeseen events, or unexpected expenses, a comprehensive policy offers peace of mind by addressing diverse risks and contingencies in a thorough and inclusive manner.