Mastering the Art of Secure Transactions with Checks

The Importance of Checks in Financial Transactions

Checks have been a fundamental part of the financial system for centuries, providing a secure and convenient way to make payments and transactions. Despite the rise of digital payment methods, checks continue to play a crucial role in various financial activities.

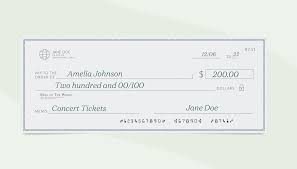

One of the key benefits of using checks is their traceability. Each check contains important information such as the payee’s name, amount, date, and signature. This documentation helps in keeping track of expenses, verifying payments, and maintaining accurate financial records.

Checks also offer a level of security that other payment methods may lack. When issuing a check, the payer can control the exact amount to be paid and ensure that it reaches the intended recipient. Additionally, checks require signatures for validation, adding an extra layer of authentication to the transaction.

Furthermore, checks provide a tangible record of payment that can serve as proof in case of disputes or discrepancies. In situations where electronic records may not suffice, a physical check can serve as concrete evidence of a completed transaction.

While electronic payments have become increasingly popular due to their speed and convenience, checks remain relevant for certain types of transactions. For example, businesses often use checks for paying vendors or employees, as well as for managing recurring expenses.

In conclusion, checks continue to be an essential tool in financial transactions due to their security features, traceability, and reliability. By understanding the importance of checks and utilizing them effectively, individuals and businesses can ensure smoother and more secure financial operations.

Top FAQs About Ordering and Using Checks

- What is the best website to order checks?

- Can I print my own checks?

- Are checks still used today?

- Is it safe to buy checks online?

What is the best website to order checks?

When seeking to order checks online, it is essential to consider reputable websites that offer a wide selection of check designs, customization options, and security features. Popular choices for ordering checks include established platforms such as Deluxe, Checks Unlimited, and Vistaprint. These websites provide a user-friendly interface, secure payment processing, and fast delivery options. It is advisable to compare prices, read customer reviews, and ensure that the website offers encryption for protecting personal and financial information during the ordering process. Ultimately, choosing the best website to order checks depends on individual preferences for design variety, pricing, and customer service quality.

Can I print my own checks?

Printing your own checks is a common practice that can offer convenience and cost savings, but it is important to proceed with caution. While it is technically possible to print your own checks using specialized software and check stock paper, there are important security considerations to keep in mind. DIY check printing requires careful attention to details such as MICR encoding, signature placement, and fraud prevention measures to ensure that the checks are valid and secure. It is advisable to follow industry guidelines and best practices when printing your own checks to minimize the risk of errors or misuse. Additionally, some financial institutions may have specific requirements or restrictions regarding self-printed checks, so it is recommended to consult with your bank before proceeding with this option.

Are checks still used today?

Checks are indeed still used today, despite the growing popularity of digital payment methods. While electronic transactions offer speed and convenience, checks remain a reliable and secure form of payment for many individuals and businesses. Checks provide a tangible record of transactions, offer traceability through detailed documentation, and ensure a level of security with required signatures. Moreover, checks are commonly used for various financial activities such as paying bills, making large purchases, and managing business expenses. Their enduring presence in the financial landscape highlights their continued relevance and importance in modern-day transactions.

Is it safe to buy checks online?

When considering purchasing checks online, it is important to exercise caution and choose reputable vendors to ensure the safety of your transactions. Buying checks online can be safe if you select established companies with secure payment systems and encryption protocols to protect your personal and financial information. It is advisable to research the vendor’s reputation, read customer reviews, and verify that they follow industry standards for data security. By taking these precautions and being vigilant about sharing sensitive details, you can confidently buy checks online without compromising your security or privacy.