Securing Your Future: The Importance of Long-Term Health Care Insurance

The Importance of Long-Term Health Care Insurance

Long-term health care insurance is a crucial component of financial planning for individuals as they age. As life expectancy increases and medical costs continue to rise, having coverage for long-term care can provide peace of mind and financial security for both individuals and their families.

Long-term care insurance typically covers services not covered by traditional health insurance, such as assistance with daily activities like bathing, dressing, and eating, as well as care in nursing homes or assisted living facilities. These services can be expensive and can quickly deplete savings if not adequately planned for.

One of the key benefits of long-term health care insurance is that it helps protect assets and savings from being exhausted due to the high costs of long-term care services. By having a policy in place, individuals can ensure that they have access to quality care without having to worry about the financial burden it may impose.

Moreover, long-term health care insurance provides individuals with the flexibility to choose the type of care they prefer and where they receive it. This empowers individuals to make decisions based on their personal preferences and needs, rather than being limited by financial constraints.

It’s important to note that the cost of long-term health care insurance can vary based on factors such as age, health status, coverage options, and the insurer. Therefore, it’s advisable to start planning for long-term care insurance early to secure more affordable premiums and comprehensive coverage.

In conclusion, long-term health care insurance plays a vital role in ensuring financial stability and access to quality care as individuals age. By investing in a policy that meets their needs, individuals can safeguard their assets and enjoy peace of mind knowing that they are prepared for any future long-term care needs.

Essential FAQs About Long-Term Care Insurance: Types, Costs, and Considerations

- What are the three main types of long-term care insurance policies?

- At what age might a long-term care policy premium be too expensive?

- At what age do the experts recommend that you begin considering purchasing long-term care insurance?

- Is it worth getting long-term care insurance?

- Is long-term care life insurance worth it?

- What is the average cost of long-term healthcare?

- What is the biggest drawback of long-term care insurance?

What are the three main types of long-term care insurance policies?

There are three main types of long-term care insurance policies that individuals can consider when planning for their future healthcare needs. The first type is a traditional long-term care insurance policy, which provides coverage for a range of long-term care services, including nursing home care, assisted living facilities, and in-home care. The second type is a hybrid long-term care insurance policy, which combines long-term care coverage with life insurance or an annuity, offering both long-term care benefits and a death benefit or investment component. Lastly, there are short-term care insurance policies that provide coverage for a limited period of time, typically up to one year, offering temporary support for individuals recovering from an illness or injury. Each type of policy has its own features and benefits, allowing individuals to choose the option that best suits their needs and financial goals.

At what age might a long-term care policy premium be too expensive?

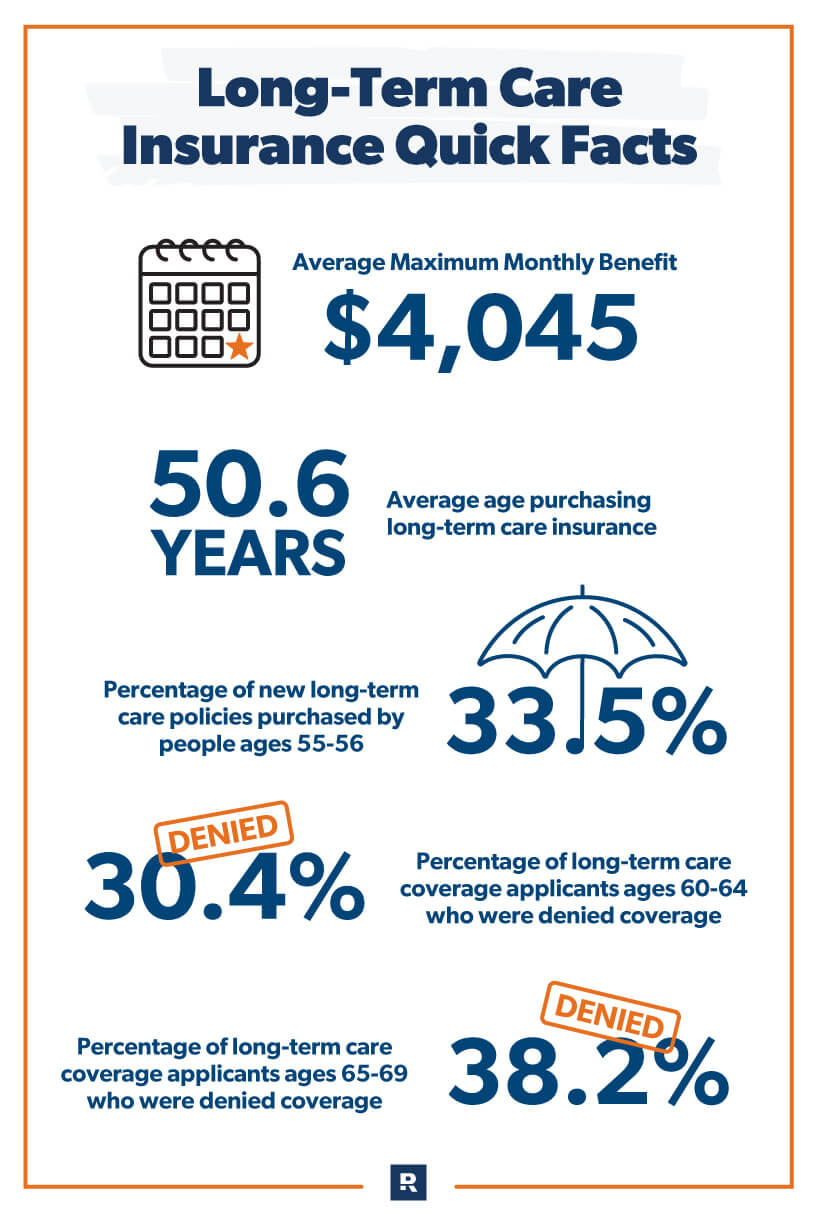

The affordability of a long-term care insurance policy premium is often influenced by the age at which an individual applies for coverage. Generally, premiums tend to be more affordable when individuals purchase a policy at a younger age, as they are considered lower risk and may have fewer pre-existing health conditions. As individuals age, especially beyond their mid-50s or early 60s, premiums may start to increase significantly due to the higher likelihood of needing long-term care services. Therefore, it is advisable for individuals to consider purchasing long-term care insurance earlier in life to secure more affordable premiums and comprehensive coverage that align with their financial goals and needs.

At what age do the experts recommend that you begin considering purchasing long-term care insurance?

Experts typically recommend that individuals start considering purchasing long-term care insurance in their mid-50s to early 60s. At this age, individuals are generally in good health, making it easier to qualify for coverage and secure more affordable premiums. By planning ahead and purchasing long-term care insurance earlier, individuals can ensure they have adequate coverage in place to protect their assets and provide for their future care needs as they age. It’s important to remember that the cost of premiums may increase with age, so starting the planning process early can help individuals make informed decisions about their long-term health care insurance options.

Is it worth getting long-term care insurance?

The decision to invest in long-term care insurance is a significant consideration for individuals planning for their future health needs. While the necessity of long-term care insurance varies based on individual circumstances, it is worth exploring for those seeking to protect their assets and ensure access to quality care as they age. The potential financial burden of long-term care services can be substantial, and having insurance coverage can provide peace of mind and financial security for both policyholders and their families. By evaluating factors such as personal health, family history, financial resources, and desired level of care, individuals can determine whether long-term care insurance aligns with their goals and priorities for comprehensive health planning.

Is long-term care life insurance worth it?

When considering whether long-term care life insurance is worth it, individuals should weigh their specific financial situation and healthcare needs. Long-term care life insurance combines the benefits of long-term care coverage with a death benefit, offering a unique financial solution for those concerned about both potential long-term care expenses and leaving a legacy for their loved ones. By investing in this type of insurance, individuals can secure coverage for long-term care services while also ensuring that their beneficiaries receive a payout upon their passing. Ultimately, the decision on whether long-term care life insurance is worth it depends on individual circumstances, risk tolerance, and long-term financial goals.

What is the average cost of long-term healthcare?

The average cost of long-term healthcare can vary significantly depending on various factors such as the type of care needed, the duration of care required, the location where the care is provided, and the individual’s health condition. In general, long-term healthcare costs can range from thousands to tens of thousands of dollars per year. Nursing home care tends to be one of the most expensive options, with average costs exceeding $80,000 per year for a semi-private room. Assisted living facilities and in-home care services may also incur substantial expenses. It is essential for individuals to consider these costs when planning for long-term care and explore options such as long-term health care insurance to help mitigate financial burdens associated with extended medical care needs.

What is the biggest drawback of long-term care insurance?

One of the biggest drawbacks of long-term care insurance is the cost associated with premiums. Premiums for long-term care insurance can be expensive, especially if purchased later in life or with comprehensive coverage options. Some individuals may find it challenging to afford these premiums, leading to the risk of policy lapses or inadequate coverage. Additionally, premiums can increase over time, further adding to the financial burden. It is essential for individuals considering long-term care insurance to carefully evaluate their budget and long-term financial goals to determine if the cost of premiums aligns with their overall financial plan.